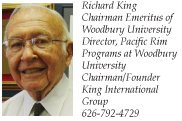

By: Richard King

While the rest of the world was suffering from the crises mode of 2011 brought about by the economic trauma in Europe, the American debt ceiling fiasco and riots in many western capitals, Asia’s economic progress showed signs of growth exceeding the expectations of most observers.

The two “economic engines” that continue to drive the Pacific Rim are China and Japan. So I believe it is appropriate to concentrate my 2012 outlook on those two countries.

First, Japan, Asia’s second largest economy. In the beginning of 2012 the pace of Japan’s economic growth should show a GNP growth of 1-2% as Japan rebounds from the economic slump due to the earthquake/tsunami disaster. Public demand will remain relatively strong due to reconstruction needs but the pace will be moderate which will result in a negative contribution to real GDP growth. At the same time, domestic, internal growth will be a primary engine. Personal consumption will be supported by the recovery of the labor market and the rise of capital investment because of the improvement of corporate earnings. External demand will probably be an insignificant contributor to Japan’s economic growth because of the weak exports due to the slowdown in the United States and Europe. So in summary, the growth in the Japanese economy will probably peak in mid 2012 and lose momentum in the second half of 2012.

There are two risk factors that could negatively impact Japan’s economic growth in 2012. One is the shortage of electrical power. Most economic observers of the Japanese economy base their growth assumption on the fact that all nuclear power plants will be back in operation by early 2012 and there will not be a shortage of electrical power. However, the timing for the start-up of all nuclear power plants is still to be determined. If nuclear power is not fully restored, there could be a power shortage in the summer of 2012 which will have a significant negative impact on Japanese economic growth. The other risk factor is the projected tax reform pending for passage in early 2012. This is a very complex subject in Japan at the present time and given the current instability of the political situation, it’s difficult to project the effect of tax reform on Japans economic growth in 2012.

Despite a global slowdown in many Asian economies, China continues its robust growth. The projected growth for 2010 was 9% and this growth figure continued for 2011 and now most experts are projecting a moderate slowdown for 2012, to 8%. China’s economy is already larger than Japan’s and I expect that it will be difficult for China to continue its present growth rates. In 2012 China’s economic growth will become more dependent on domestic consumption demand because of the increase in consumer income. Regarding international trade, China will maintain its role of the leading exporter. Not only exports but also imports will increase due to the fact that China has a great need for imported components and raw materials.

In summary, China will continue a rather healthy economic growth of 8% in 2012 and inflation will gradually ease. It should be kept in mind that the projections for Chinese economic growth in 2012 is based on a projection of 2% GDP growth in the US and a stabilizing of the European economies.

So in 2012 the two economic engines of the Pacific Rim, China and Japan, will continue to drive the Pacific Rim economy. Japan should achieve 1-2% GNP growth and China probably 8% GNP growth. The big question mark for both of these countries is the political situation. In China we will see a change of administration in 2012 and it is still too soon to determine the impact of the new leadership on the Chinese economy. In Japan we have a similar situation where current political leadership is unstable and we do not know if Japan can bring about the political stability needed to improve its economic growth.

|