By: William R. Boyd, Jr.

Much to the relief of local office building owners, the Tri-City (Burbank, Glendale and Burbank) office market predictions at the end of last year were confirmed in the first half of 2011 as office vacancy decreased over the previous year.

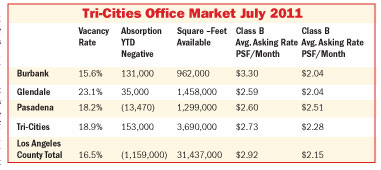

The recent leasing activity in the first six months of 2011 brought the Tri-City’s office space vacancy to 18.9% of the market’s total 19.4 million square feet of non owner-user office buildings down from 19.2% one year ago. The Tri-City office market experienced positive net absorption of 153,000 square feet during the first six months of 2011 compared to a negative absorption (tenant’s moving out of space) of 319,000 square feet last year.

Over the past year office space vacancies decreased in Pasadena and Burbank but increased in Glendale to 23.1% compared to 21.8% last year of the city’s 6.3 million square feet. Burbank office space vacancy decreased to 15.6% from its 17.3% vacancy last year within its total 6.2 million square feet of space while Pasadena had an improved vacancy of 18.2% within its 6.9 million square foot office space base over the past year.

The few tenants moving into the market have not been enough to stop the “hemorrhaging” of increased office space vacancy within the Glendale office market. Despite the recent leasing activity at Glendale’s Galleria office tower and the Unum building, at 655 North Central Avenue, such Glendale tenants as State Farm Insurance did lease 25,000 square feet at the Unum building this year but vacated 35,000 square feet at another Glendale building.

Most observers feel the worst is over for the Tri-City office market and most commercial real estate professionals believe the positive news for the Tri-City office market may continue this trend although modestly. “While tenants such as law firm Christie, Parker & Hale move to Glendale later this year from Pasadena it will be great for Glendale but not increase the Tri-City occupancy,” said Mark Miller of Stevenson Commercial Real Estate, a Glendale firm.

The severe amount of office space vacancy and slow leasing activity is creating outstanding office space opportunities for those few tenants in the market seeking office space or those tenants looking to renew their current lease obligation. Glendale’s quoted average rental rate for class A office space has dropped over the past year from $2.76 per square foot per month on a fully serviced basis to $2.59 per square foot today.

The average asking rental rate for Class A office space in the Tri-Cities office market was at $2.90 per rentable square foot per month on a fully serviced basis as of the end of the second quarter 2011, due to the higher rents quoted in Burbank’s new office buildings, but has now dropped to $2.73 per rentable square foot per month. Very little “rent erosion” is expected through the remainder of this year.

A unique twist in the market saw the average asking rental rate for Class B office space increase to $2.28 per square foot per month on a fully serviced basis up from $2.25 per square foot last year.

William R. Boyd, Jr.

Senior Managing Director

Charles Dunn Company, Inc.

100 West Broadway Suite 510

Glendale, California 91210

Tel 818 550-8200

Fax 818 550-8221

|